Research Seminars

Social Preferences and Inequalities: Updates in Behavioral Economics and Experimental Studies

2025 Martín Leites

Workshop: Social Preferences: Beyond Self-Interest

This interactive workshop invites Economics students to explore how issues such as inequality, equity, altruism, and social justice influence real economic behavior. Through participatory activities and experimental games, we challenge traditional microeconomic assumptions, revealing that our decisions are shaped not only by self-interest but also by social values and norms of reciprocity. It’s an opportunity to reflect, debate, and broaden your perspective on how we understand and teach economics

2025 Valentina Goglio

Continuous Learning in the Digital Age: Solution or New Barrier?:

The international seminar «Continuous Learning in the Digital Age: Solution or New Barrier?» examines the challenges and opportunities of digital training and human capital development in the context of the Fourth Industrial Revolution. The event explores the current landscape of digital skills in the European Union, the benefits and limitations of online education platforms, the impact of the COVID-19 pandemic on lifelong learning, and persistent socioeconomic inequalities in access to digital training. Core topics include reskilling and upskilling, lifelong learning, and the transformation of the labor market. The seminar aims to deepen understanding of digital training challenges, analyze strategies to reduce skills gaps, and discuss the future of education and work in an increasingly digital society

2025 Vittorio Pelligra

Trust & Reciprocity:

Challenging Economic Models ¿What’s the focus?

Researchers tested how people decide to trust others in economic games, focusing on menu-dependence (choices influenced by unselected options) and reciprocity (rewarding kindness).

Key findings:

- No menu-dependence effect: Trustees don’t repay trust based on how “kind” the trustor’s choice was.

- Fast, intuitive trust: Decisions to trust are quicker and less calculated than self-interested choices.

- Trustors anticipate this: People correctly predict that trustees won’t adjust their trustworthiness based on perceived kindness.

Why it matters:

Challenges classic theories (e.g., Rabin, Falk) that assume reciprocity depends on intentions. This helps design better systems for cooperation in business, policy, and daily life.

Trust as a Common

Building Societal Bonds ¿What’s the focus?

Trust is the “glue” holding society together, but it’s fragile. Eroding trust can lead to a “tragedy of the commons” (shared resources collapse due to lack of cooperation).

Key points:

Interpersonal vs. institutional trust: Trust in people vs. trust in institutions (e.g., governments, schools) shapes social cohesion.

Solutions: Strategies to rebuild trust, fostering cooperation and prosperity.

2024 Valentina Goglio

Valentina Goglio is Associate Professor of Economic Sociology at the Department of Cultures, Politics and Society of the University of Turin, Italy and Affiliate of Collegio Carlo Alberto, Italy.

Her research interests are at the intersection between education and the labour market, with a particular focus on the implications of the digital transformation for education and work. She holds a PhD in Labor Studies from the University of Milan and has been Marie Skłodowska-Curie Fellow with the Project «MOOC_DaSI».

Her recent publications are: «Mapping the Evolution of Platform Society» (with C. Biancalana), «Job insecurity and Life Courses» (with S. Bertolini and D. Hofacker) and «The Diffusion and Social Implications of MOOCs. A Comparative Study of the USA and Europe»

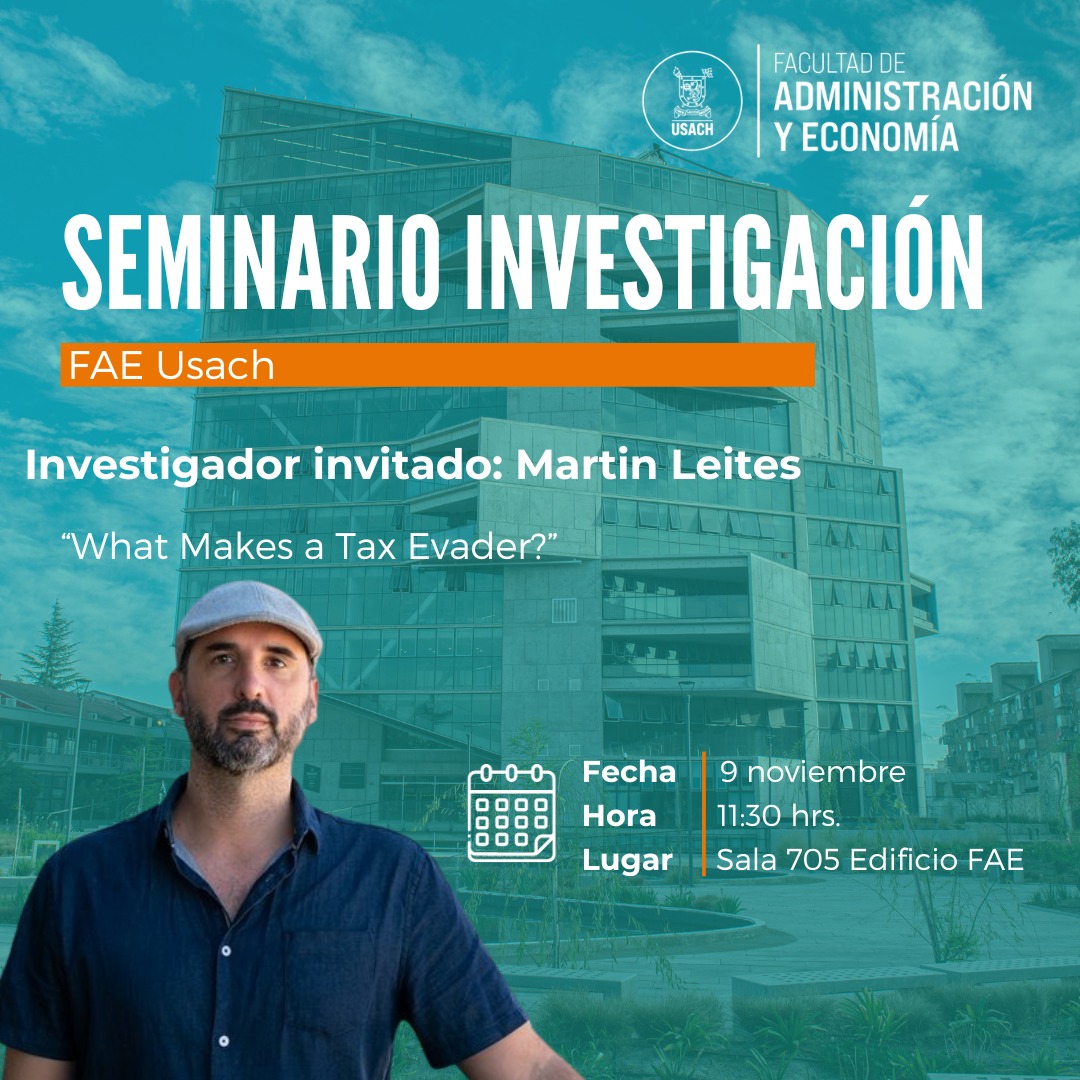

2023 Martín Leites

Why do some individuals choose to evade taxes while others do not? One popular view is that some individuals cheat on their taxes because they are more dishonest, selfish, or have different beliefs on social norms for compliance. There is, however, little direct evidence on this matter. In collaboration with the national tax agency in Uruguay, we address this question using a combination of surveys and administrative records. Leveraging a unique institutional setting, we measure individual-level evasion choices. We document significant variation in evasion decisions across individuals. For a subsample of 6,078 taxpayers, we use survey questions and incentivized laboratory games to measure traits such as honesty, selfishness, and beliefs on compliance norms. We find that these individual characteristics have \emph{some} power to predict who evades taxes. However, other factors, such as the marginal tax rates and the behavior of peers, play a bigger role.